How Community-Owned Financial Institutions Empower Resilient, Self-Reliant, and Prosperous Futures in Underserved Regions

The Power of Financial Cooperation

In our fight to lift Busoga out of poverty, financial cooperatives stand out as a beacon of hope. By coming together to create and own financial institutions, community members can build a future grounded in shared prosperity, dignity, and self-reliance.

Donate today to empower vulnerable communities in Uganda’s poorest region with the tools, knowledge, and networks to build thriving, member-owned financial institutions.

Financial cooperatives are more than banks. They are member-owned and operated institutions, where each member is both an owner and a customer. They exist not to maximise profits, but to ensure fair, transparent, and inclusive financial services for all.

What Are Financial Cooperatives?

Financial cooperatives — such as credit unions and savings and credit cooperatives (SACCOs) — are built by people who share common bonds, such as working in the same sector or living in the same community. Unlike traditional banks that prioritise profits, financial cooperatives prioritise members’ financial wellness, offering competitive interest rates, lower fees, and personalised service.

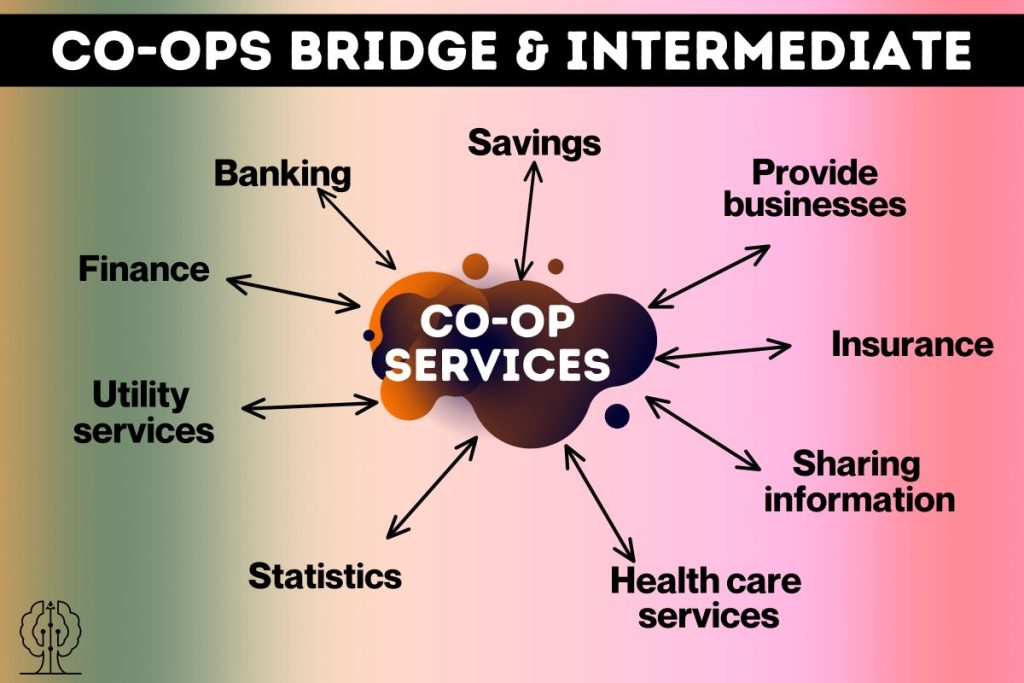

They provide a full range of banking services, including:

- Checking and savings accounts

- Affordable loans for education, housing, and business

- Insurance and investment services

- Financial literacy training

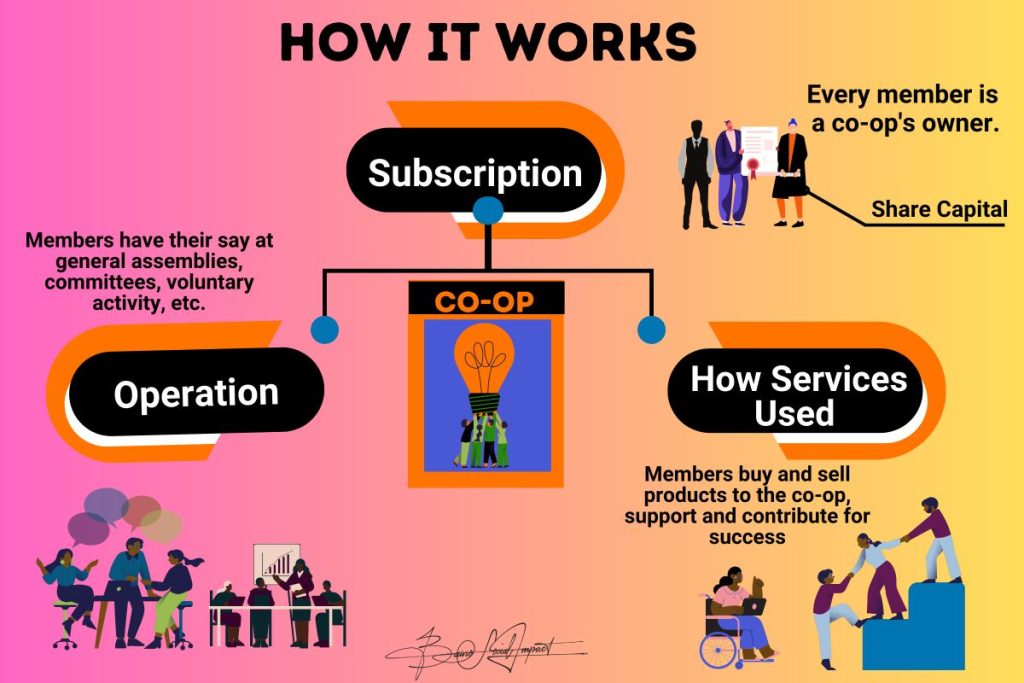

How They Work

The strength of a financial cooperative lies in its members. As more people join:

- The cooperative gains more resources to offer financial products

- Fees decrease while savings yields and loan affordability increase

- Members gain access to discounted services through collective bargaining

Most cooperatives form a board of directors drawn from their members to ensure transparency, accountability, and strategic leadership aligned with community needs.

Why Financial Cooperatives Matter for Busoga

Building Self-Reliance: They empower communities to take charge of their financial futures, breaking dependence cycles.

Pooling Resources: By combining resources, members can access services that would be unattainable individually.

Inclusive Growth: Financial cooperatives make credit and financial services accessible to low-income individuals, women, and youth, fostering equitable development.

Mutual Support & Networking: Cooperatives create spaces for members to exchange knowledge, build relationships, and strengthen collective resilience through local and national gatherings.

Examples of Impactful Financial Cooperatives

- Agricultural Cooperatives: Farmers and agribusiness owners pool savings to access capital for seeds, equipment, and market expansion.

- Housing Cooperatives: Members buy stakes in shared housing, ensuring affordable, dignified shelter.

- Consumer Cooperatives: Communities band together to access better pricing on essential goods and services, from groceries to healthcare.

Beyond Financial Services: Collective Bargaining Power

Many cooperatives negotiate discounted rates for their members on products and services through central support organisations. This means even small-scale members benefit from competitive pricing usually reserved for large buyers — enhancing their economic security.

A Culture of Shared Prosperity

Financial cooperatives do more than provide banking services. They cultivate a culture of mutual support, trust, and dignity. Members share ideas, resources, and opportunities at local, regional, and national gatherings, creating powerful networks for growth and innovation.

Your support can help us strengthen and expand financial cooperatives across Busoga, equipping the region with sustainable, community-owned institutions that build lasting prosperity.

Donate today to invest in dignity, resilience, and self-reliance for generations to come.