Fighting Poverty to End Inequality, Restore Dignity, and Break the Cycle of Hopelessness.

Poverty in Uganda — and especially in the Busoga region — is not just a lack of money. It’s a form of daily violence.

It strips people of their dignity, denies basic rights, and blocks entire communities from reaching even the minimum conditions for human well-being.

In Uganda’s rural regions, poverty lives inside homes — in empty plates, leaking roofs, untreated illness, and children who go to school hungry or not at all. The silent suffering it causes runs deep, yet remains invisible to many beyond the margins.

Uganda’s Deep Poverty Crisis

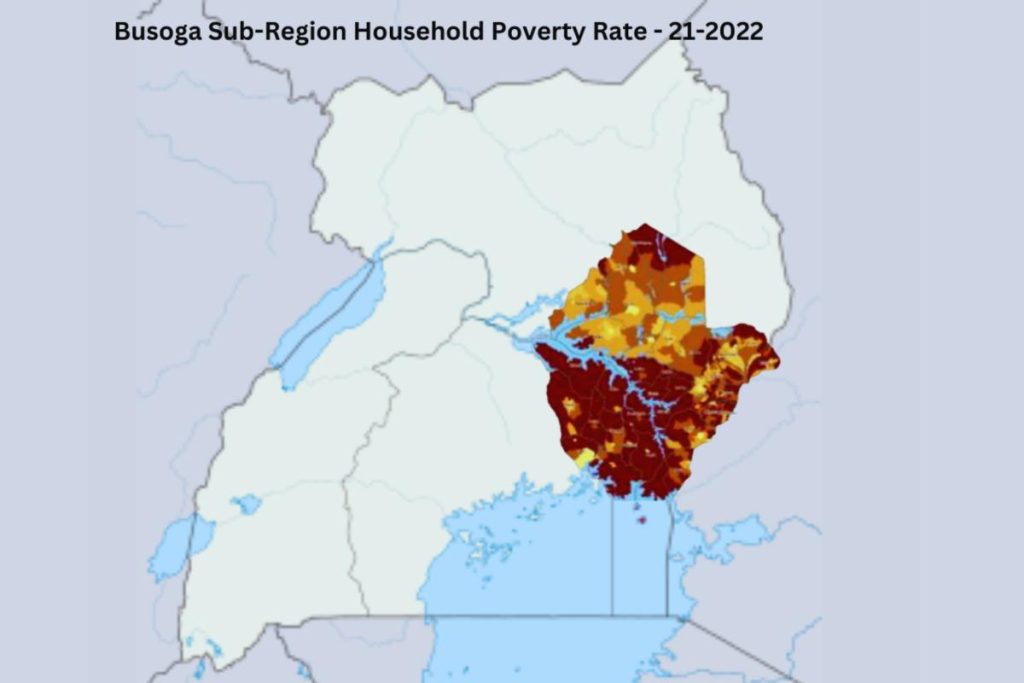

Uganda is one of the world’s poorest nations, and Busoga remains its most impoverished region — a fact confirmed by the Uganda Bureau of Statistics (UBOS). According to 2019/2020 data:

- Over 41.7% of the population lives in extreme poverty.

- For millions, absolute poverty means daily life without nutrition, education, clean water, or access to basic healthcare.

- Uganda’s national poverty line is estimated between US$0.88 and US$1.04 per day — far below the World Bank benchmark of US$1.90/day.

This is not just hardship. It is generational exclusion. It breeds inequality, fuels discrimination, and locks families into inherited deprivation that becomes increasingly difficult to escape.

Poverty is violence that doesn’t just kill dreams. It steals futures.

Poverty in rural Uganda is more than a statistic — it’s a daily humiliating injustice that erodes dignity and steals opportunity across generations. But it can be stopped. Your support can help unlock paths to education, health, and self-reliance.

Donate now. Spark hope. Break the pattern. Inspire lasting change.

Busoga: The Poorest of the Poor

- Busoga, in Eastern Uganda, lies deep within the heart of sub-Saharan Africa’s poverty belt.

- The Uganda Bureau of Statistics (UBOS) report (updated: 2022) confirmed it: Busoga is Uganda’s poorest region.

While national poverty levels have declined slightly, Busoga’s poverty has grown deeper and broader. The national figures mask these regional inequalities:

- Poverty in Busoga surged from 24.3% in 1999/2000 to 35.7% by 2016/17.

- The 2016/17 Uganda National Household Survey showed poverty nationwide rose from 19.7% (2012/13) to 21.4% — but this increase hit Busoga the hardest.

Why Is Busoga Left Behind?

- Rural disadvantage: 80% of Busoga’s population lives in rural areas where poverty rates are far higher than in towns.

- Economic trap: Most households depend on agriculture, forestry, or fishing — sectors where poverty is most severe.

- Neglect in national programs: The government’s Poverty Eradication Action Plan (PEAP) focused public investment in Central and Western Uganda, accelerating poverty reduction there — but leaving Busoga behind.

Poverty’s Ripple Effects

The crushing poverty in Busoga reaches into every part of life:

- Education: School dropouts, overcrowded classrooms, lack of supplies (→ link to education section)

- Health: Limited access to clinics, clean water, and sanitation

- WASH: Poor water, sanitation, and hygiene services contribute to disease and lost productivity

This isn’t just poverty — it’s a humanitarian crisis hidden in plain sight.

Your support can help reverse these alarming trends:

- Invest in poverty reduction programs that directly reach Busoga’s rural families

- Support vocational training that creates real economic opportunity

- Help fund clean water, sanitation, and health initiatives

- Join efforts to provide equitable educational access

Together, we can help end this silent violence.

Poverty may not throw punches, but it leaves bruises just the same—on the futures of children denied an education, on the bodies of mothers who give birth without care, and on the minds of youth who never learn to dream beyond survival. It’s a silent violence: slow, invisible, and widespread. It doesn’t scream—but it suffocates. Together, we can interrupt this quiet cruelty. Together, we can dismantle the barriers that rob children of opportunity, rob families of choice, and rob communities of hope. Ending poverty is not charity—it is justice.

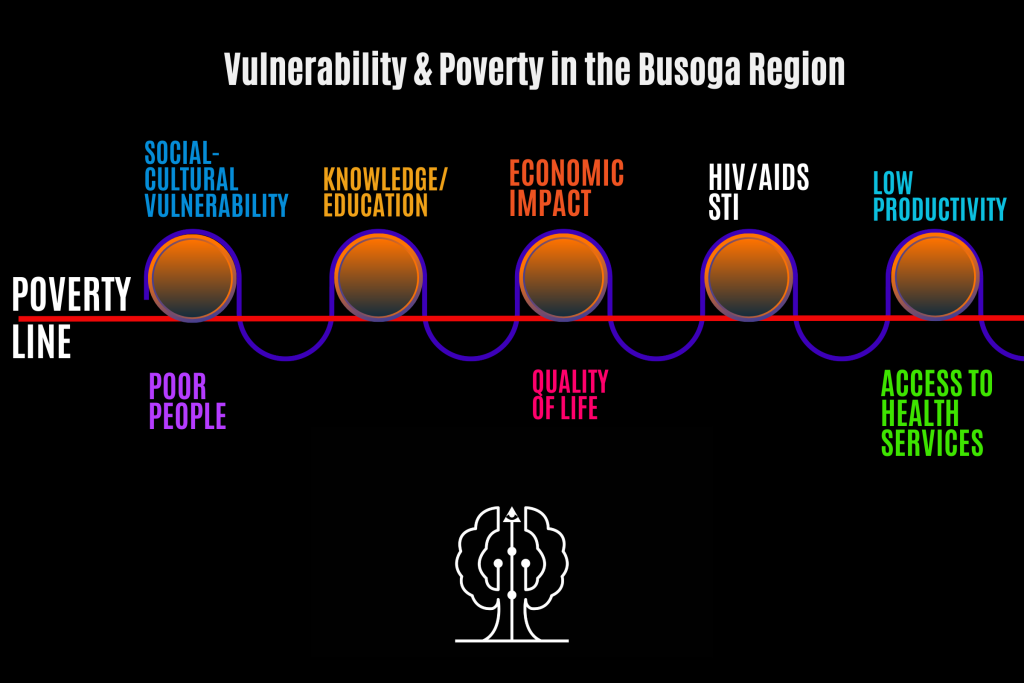

Vulnerable to Poverty and the Working Poor

In Busoga, Uganda, many families are not far from poverty — they are perched precariously on its edge.

➡ The vulnerable to poverty are those whose household income or expenditure is just above the poverty line. They are one illness, one bad harvest, or one crisis away from falling back below it.

➡ The working poor are individuals who may work long hours, but their earnings (measured by household expenditure as a proxy for income) still fall below the poverty line. These are families stuck in survival mode, with no safety net.

Whatever measures lifted them temporarily above the poverty threshold did not address long-term resilience or protection from slipping back.

Poverty: The Major Constraint to Sustainable Development

Ending poverty in all its forms is Goal #1 of the Sustainable Development Goals (SDGs). But in Busoga, poverty remains the primary barrier to achieving these global targets.

Poverty is the single greatest obstacle to progress in:

- Education

- Health

- Environmental sustainability

- Economic growth

Busoga’s vision is to become a literate, ecologically sustainable, and developed society — but poverty continues to block that path.

The money-metric approach to measuring welfare assumes that households above the poverty line have the purchasing power to achieve a basic level of well-being. Yet, in Busoga, even those slightly above this line live in constant vulnerability.

How Poverty Is Measured: The UNHS Approach

The Uganda National Household Survey (UNHS) measures poverty using household expenditure rather than income.

- Expenditure data is more reliable — people are more willing to share what they spend than what they earn.

- Expenditure reflects longer-term living standards tied to expected earnings.

The 2016/17 UNHS gathered data on:

- Income from salaries, wages, enterprises, and subsistence farming

- Property income

- Transfers (cash, in-kind, mobile money, bank deposits, remittances via Western Union, MoneyGram, etc.)

Key Findings on Household Income in Busoga

- Most households received income as cash (56%), followed by in-kind payments (31%).

- Busoga’s average nominal monthly household income rose modestly from UGX 194,900 (2012/13) to UGX 222,000 (2016/17).

- However, 2019 data showed that average household monthly expenditure declined, while poverty rates increased significantly.

- Among households relying on subsistence farming:

- 53% received income in cash

- 42% in-kind

- For those dependent on remittances:

- 48% received income in-kind

- 17% via mobile money

These patterns reveal a highly informal, fragile economy where many families lack stable, reliable cash income.

The Hidden Risk: Informal and In-Kind Incomes

The large share of in-kind payments underlines the informality of Busoga’s economy. This makes families more vulnerable to shocks — because what they receive often can’t be easily saved, invested, or used flexibly in emergencies.

To break this cycle, the region needs:

- Programs that strengthen formal income opportunities

- Access to fair financial services

- Investments in resilient rural livelihoods

Ownership and control of income-generating assets

In Busoga, Uganda, owning and controlling income-generating assets like land, housing, and livestock offers critical advantages:

- A secure place to live

- A livelihood source

- A safety net in emergencies

- Collateral for loans

Sources of Data

Sources of Data

Sources of Data

➡ The Uganda National Household Survey (UNHS) recorded assets such as:

- Agricultural land

- Homes

- Livestock

- Furniture, appliances (TVs, refrigerators)

- Bicycles, motor vehicles

- Radios, mobile phones

- Household electronics (cassettes, home theatres)

These assets shape household resilience and the ability to escape poverty.

Data Sources on Poverty and Livelihoods

Uganda’s poverty data comes mainly from household surveys conducted by the Uganda Bureau of Statistics (UBOS), including:

- National Household Surveys: 1999/2000, 2005/06, 2012/13, 2016/17

- Demographic and Health Surveys (DHS): 2000/01, 2005/06, 2010/11, 2016/17

- 2014 National Population and Housing Census

These reliable data sources help map poverty trends and inform interventions.

Savings Mechanisms in Busoga

Most households rely on informal savings methods:

- 33% keep money at home or in secret places

- 16% save with Village Savings and Loans Associations (VSLAs)

- Only 8% use commercial banks

Formal savings options: commercial banks, Microfinance Deposit Institutions (MDIs), Microfinance Institutions (MFIs), SACCOs.

Informal savings options: keeping money at home, VSLAs, Rotating Savings and Credit Associations (ROSCAs), Go Rounds, mobile money.

👉 The low use of formal savings channels reflects the need for greater financial inclusion.

Household Investments

When asked about investment choices:

- 88% saw personal businesses as a key option

- 82% identified livestock

- 59% actively invested in farmland

- 42% in livestock

- Only 1% used fixed deposit accounts

These patterns show that Busoga households prioritize tangible, local investments over formal financial products.

Where People Borrow Money

Most loans and credit come from informal sources (79%), such as:

- VSLAs (31%)

- Family, friends, moneylenders

Only 21% borrow from formal sources — mainly:

- Commercial banks (9%)

- SACCOs (7%)

Reasons for borrowing:

- 25% for consumption needs

- 23% for education expenses

- 18% for business inputs or working capital (mainly near towns)

The Rise of Mobile Money

Mobile money is transforming financial services in Uganda, offering a vital alternative where banking access is low.

Key stats from the survey:

- 75% of household members (16+) know about mobile money (81% of males, 70% of females)

- 59% of those knowledgeable have registered mobile money accounts (64% of males, 53% of females)

Mobile money has deepened financial inclusion, helping families manage payments, remittances, and savings more easily.

Poverty in rural Uganda — especially in the most impoverished communities we serve — is a formidable enemy.

It destroys potential, fractures families, and steals futures. Uprooting it won’t be easy. But with your help, we can lay a foundation for lasting change.

In places where banks are distant and roads are few, mobile money is more than a convenience—it’s a lifeline. With a simple phone, a mother in a rural village can receive urgent help to buy food, pay school fees, or access medical care. It turns isolation into connection. It makes giving immediate, transparent, and impactful. Financial support doesn’t wait weeks to travel—it reaches the heart of need in minutes.

Support our mission. Donate now!