It Fosters Every Virtue, Teaches Self-Denial, Cultivates a Sense of Order, Trains Forethought, and Broadens the Mind.

Household savings behaviours are largely influenced by ability, willingness and the opportunity to save.

Many once-struggling societies in the world deeply inculcated some of the most essential behaviours in their daily lives as one of the avenues to chasing poverty out of their midst. Busoga needs to do just that, as well.

To eventually eradicate poverty, saving money is a fundamental behaviour to encourage and adopt as part and parcel of people’s lives in Busoga region.

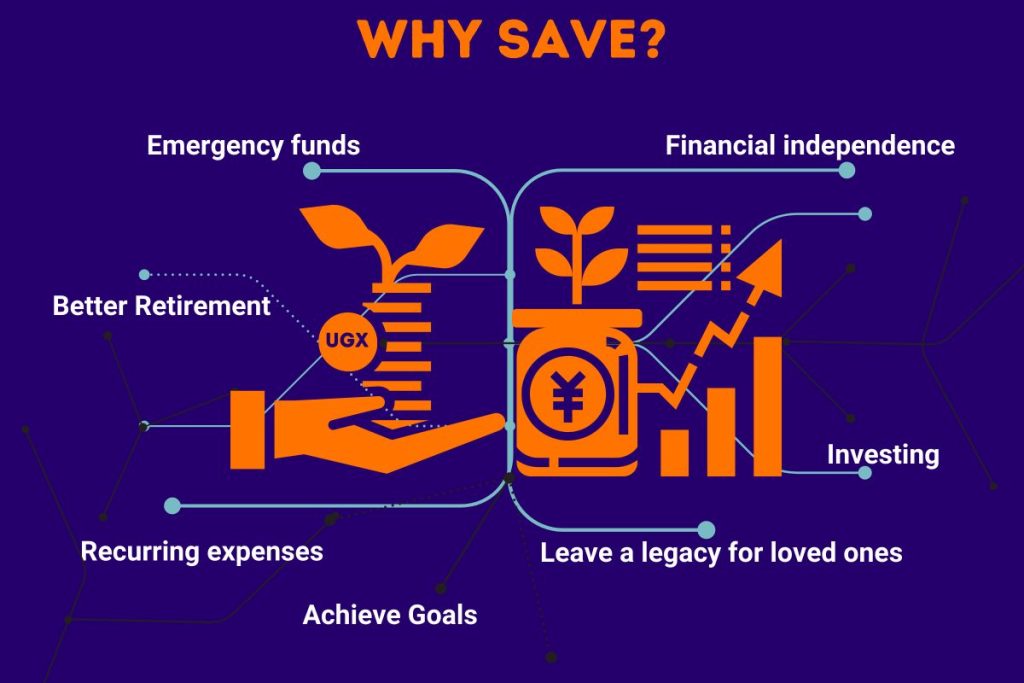

Saving is setting aside a portion of current income for future use or the flow of resources accumulated over time. Savings is the money or income not spent or deferred. It’s the amount a person has left over when subtracting their consumer spending from their disposable income over time.

Savings can also be used to increase income through investing. It can be a go-to resource in case of any emergency.

Conceptually, we characterise an individual’s savings behaviour by the proportion of disposable income in a period that is not consumed but instead invested (or saved) for future consumption or bequest.

Household savings behaviour is largely influenced by the ability, willingness, and opportunity to save, which are reflected in income, wealth, dependency ratio, education, age, occupation, interest rates and the level of financial intermediation or transaction costs.

Financial knowledge, attitude, self-efficacy, and management practice are other determinants that can influence saving behaviours. Although this is only sometimes the case, people with high financial understanding will likely be better positioned to make intelligent, sound financial decisions and have solid financial planning.

The saving habit is not about how much someone earns but about the actual behaviour: the discipline to set aside some amount from whatever one makes.

The habit of saving money is a habit of a victor.

As per the national survey, some of the current saving mechanisms in the Busoga region are, in order of popularity: keeping money at home in a secret place, Saving with Village Savings and Loans Associations (VSLAs), and commercial bank accounts.

Microfinance deposit institutions (MDIs), Microfinance Institutions (MFI), Savings and Credit Cooperatives (SACCOs), Rotating Savings and Credit Associations (ROSCAs)—Go Rounds, and Mobile Money services—are also gaining ground.

INVESTMENT

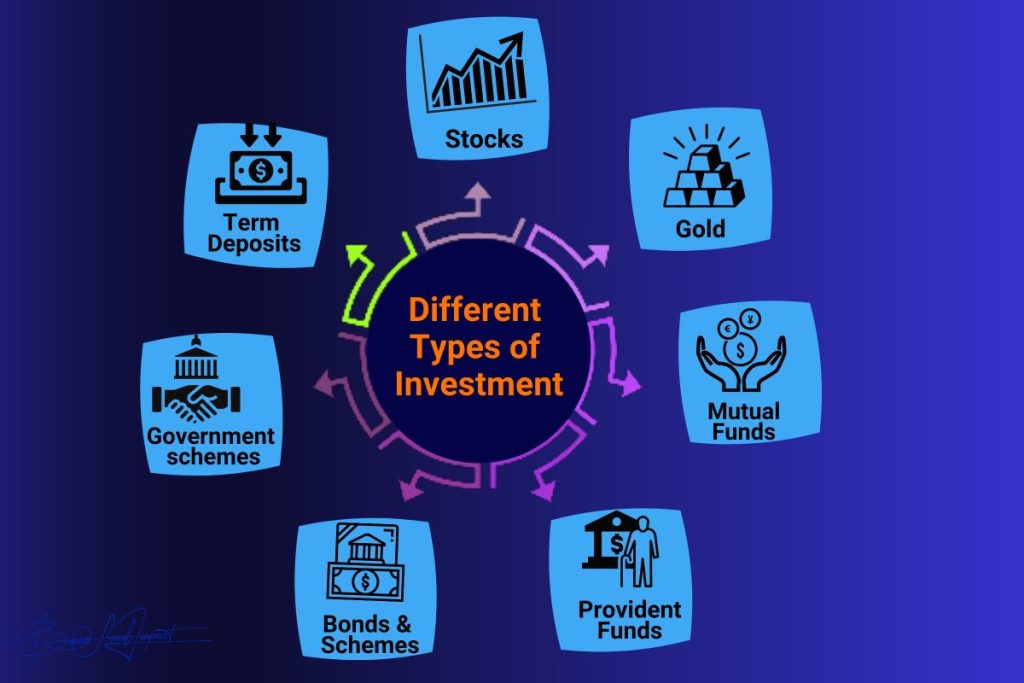

To invest is to allocate saved money with the expectation of some benefit in the future.

Investment involves purchasing an asset or goods that are not consumed today but will be used to generate wealth. An investment concerns the outlay or expenditure of some capital today—time, effort, money, or an asset—in the hope of a greater payoff in the future than what was originally put in. Sometimes the benefit from an investment is called a return.

Simply put, investing in any process is utilised to generate future income. It describes the process of putting money to work, such as starting or expanding a project, purchasing an asset or interest, or assembling the production tools and procedures to make other commodities in the hope of making a profit or getting a superior material result.

Saved funds can be put to work, that is, invested, to increase their value over time.

Purchasing bonds, stocks or real estate property or even choosing to pursue additional education may also fall under the term ‘investment’.

Investment is an important topic because it can exponentially multiply one’s initial input into several folds. Such knowledge would benefit all financially struggling communities worldwide, starting with Busoga region.